16 Which of the Following Best Describes Term Life Insurance

The insured can borrow or collect the cash value of the policy. All of the following statements regarding term life insurance are correct EXCEPT.

High School Biology Midterm Biodiversity Evolution High School Biology Midterm Biology

B a 3-year renewable policy allows a term policyowner to increase coverage for the next 3 years.

. B It provides an annually increasing death benefit. The insured pays a premium for a specified number of years. The insured pays the premium until his or her death.

You get sick and are hospitalized for 4. C an option to convert provides that a term life insurance policy can be exchanged for a. The insured pays the premium until his or her deathC.

A term insurance policy and a whole life policy c. C It is level term insurance. The insured pays the premium until his or her death.

Suppose that under your health insurance policy hospital expenses are subject to a 1000 deductible and 250 per day copay. Added 5 hours 14 minutes ago4222022 32824 AM. The insured is covered during his or her entire lifetime.

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Which of the following best describes term life insuranceA.

The insured can borrow or collect the cash value of the policy. Which of the following combinations best describe a universal life insurance policy. If the claim is disputed in court and the insurer loses the face amount will.

The insured pays a premium for a specified number of years. Is a tool to reduce your risks. The insured is covered during his or her entire lifetime.

The insured is covered during his or her entire lifetime. Which of the following best describes annually renewable term insurance. AIt requires proof of insurability at each renewal.

A term insurance only B a form of fixed face fixed premium whole life insurance C a whole life policy where the face amount may be changed at any time D providing more flexibility in paying premiums. The insured pays a premium for a specified number of years. Which of the following best describes term life insurance is a tool to reduce your risks.

And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. Credit life insurance is a group form of life insurance that is owned by and benefits only the creditor in the event of the death of the borrower. The insured is covered during his or her entire lifetimeB.

Term life insurance covers you during the most important years of your life The best time to open a term life insurance policy is when youre expecting to make a big life decision. A flexible premium deposit fund and a monthly renewable term insurance policy. Which of the following best describes term life insurance.

A universal life insurance policy ULI is considered to be. The following best describes term life insurance. The insured pays a premium for a specified number of years.

B A 10-year renewable term is a policy in which the premium and face amount increase at the end of each 10-year period. Which of the following BEST describes a double indemnity provision in travel accident insurance. Benefits are doubled under certain circumstances stated in the policy b.

The insured pays a. The insured pays the premium until his or her death. Which of the following best describes term life insurance.

A A 10-year renewable term is a policy with a level premium and a corresponding decreasing face amount. A Neither the premium nor the death benefit is affected by the insureds age. Which of the following best describes term life insurance.

Which of the following best describes annually renewable term insurance. DIt is level term insurance. A modified endowment policy and an annual term insurance policy d.

CIt provides an annually increasing death benefit. What best describes term life. The insured pays a premium for a specified number of years.

It may be issued as an indeterminate amount of coverage as for a credit card or it may be a single premium type of coverage in the form of decreasing term for a short term debt such as an. Which of the following best describes term life insurance. Of the following which statement best describes a 10-year renewable term life insurance policy.

The following best describes term life insurance. The insured can borrow or collect the cash value of the policy. Search for an answer or ask Weegy.

Log in for more information. A mutual fund and an endowment policy b. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

Starting a family getting married starting a business or switching to a profession where danger is involved are all great reasons to take out a policy. BNeither the premium nor the death benefit is affected by the insureds age. A a 3-year renewable policy allows a term policyowner to renew the same coverage for another 3 years.

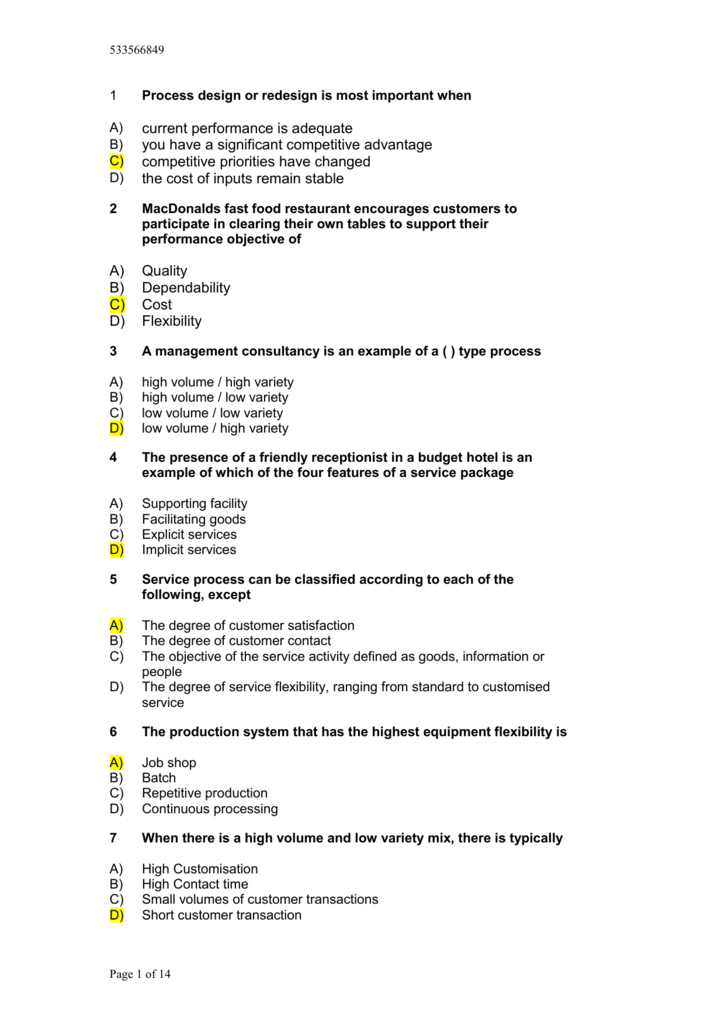

Answers To Multi Choice Session 2 Product Process Layout Design

Comments

Post a Comment